In this Weekly Update about My Life in Markets for the week ending April 14th 2024, I will share my views and some relevant data events of my interests. I will also be doing a quick round up of economic events and significant news flow. On some of these points, I may also share my personal take which may or may not be accurate and which may or may not stand the test of time.

For me the key objective of these weekly updates is to improve as a trader, investor and commodities producer.

Warning

Trading and investing in risky assets may not be suitable for everyone. Investment in general involves risk. You should only trade in financial products that you are familiar with and understand the risk associated with them. While I trade and invest, I do not recommend that anyone should take any sort of risk based on the content that I share on this blog or my social media accounts. For trading and investments you should seek advice from an independent financial advisor.

News Flow

Headlines

- Israel Hamas War Continues.

- Iran Attacks Israel with 200 Missiles and Drones.

- Inflation in US Not Falling As Per Expectations, Rise More Than Forecasts.

- ECB Signals Rate Cut in June 2024, Asserts Independence from The Fed.

- Russia Ukraine War Continues with Ukraine’s Defenses Weakening.

- S&P 500 Index lost 1.56% to close at 5,123.41 this week.

- Fitch downgrades outlook on China to negative, affirms ‘A+’ rating.

War Against Hamas

Israel’s military offensive in the Gaza Strip has killed at least 33,686 Palestinians and wounded 76,309 since Oct. 7, the Palestinian enclave’s health ministry said on Saturday. Here it must be noted that the offensive is a result of 2023 attack by the terrorist outfit Hamas in which it killed 1,139 people in Israel. This included 695 Israeli civilians (including 36 children), 71 foreign nationals, and 373 members of the security forces. About 250 Israeli civilians (including children) and soldiers were taken as hostages to the Gaza Strip.

Iran launched 200 drones and missiles at Israel in a retaliatory attack.

April 13th, 2024.

Meanwhile, Iran launched 200 drones and missiles at Israel in a retaliatory attack. Speculations were rife over the past few days that Iran may retaliate against the alleged attack by Israel on Iranian embassy in Damascus. Israel too had braced for an attack by Iran or its proxies as warnings grew of retaliation for the attack on Iran’s embassy compound that killed a senior commander in the Iranian Revolutionary Guard Corps’ overseas Quds Force and six other officers. More about this incident can be read here.

Inflation

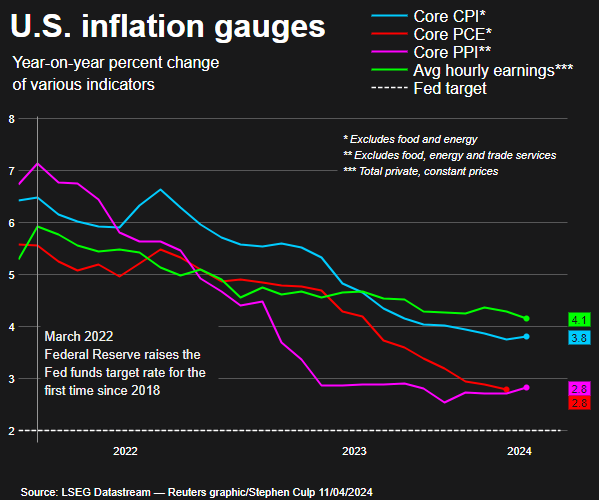

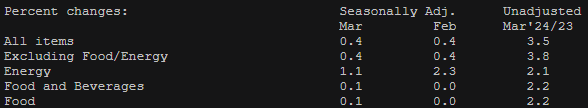

US CPI Increased by 3.50% Year on Year for March 2024.

April 10th, 2024.

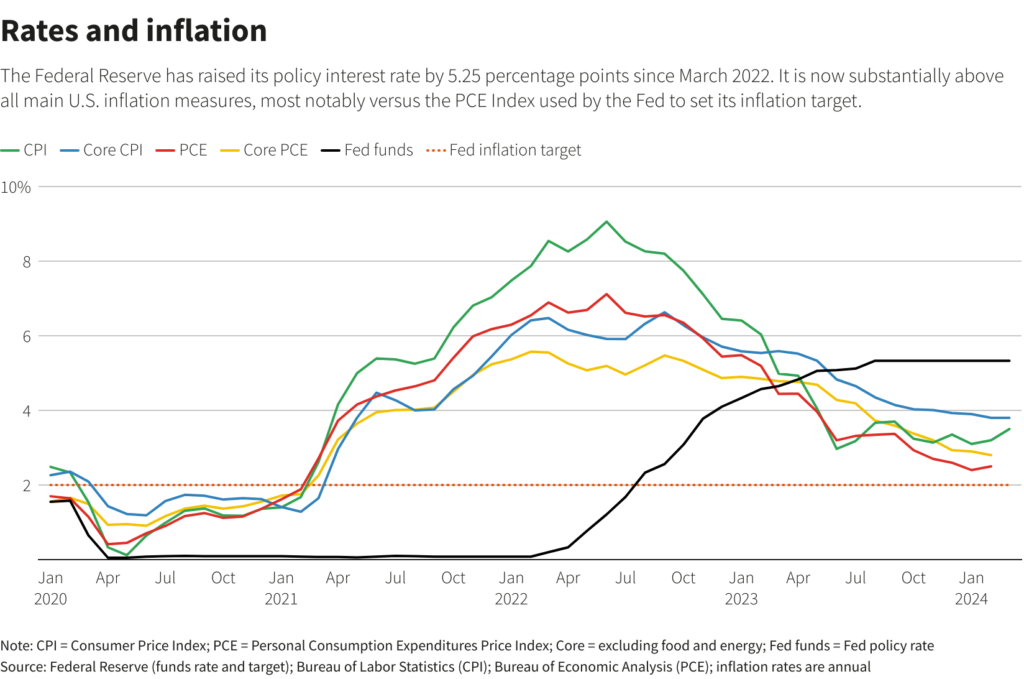

US CPI Increased by 3.50% Year on Year for March 2024. This was more than the forecast of 3.40%. Federal Reserve targets inflation of 2.0%.

Federal Reserve

Interest Rates

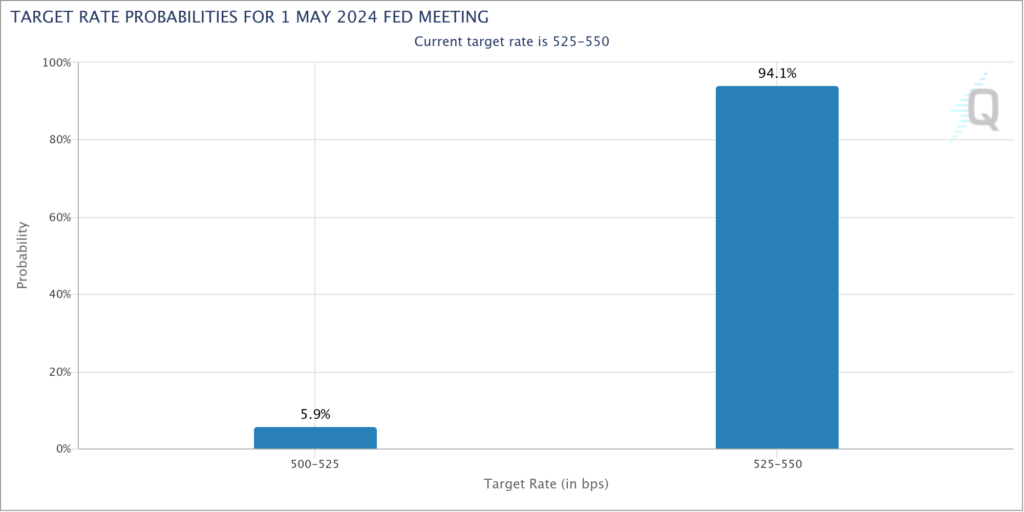

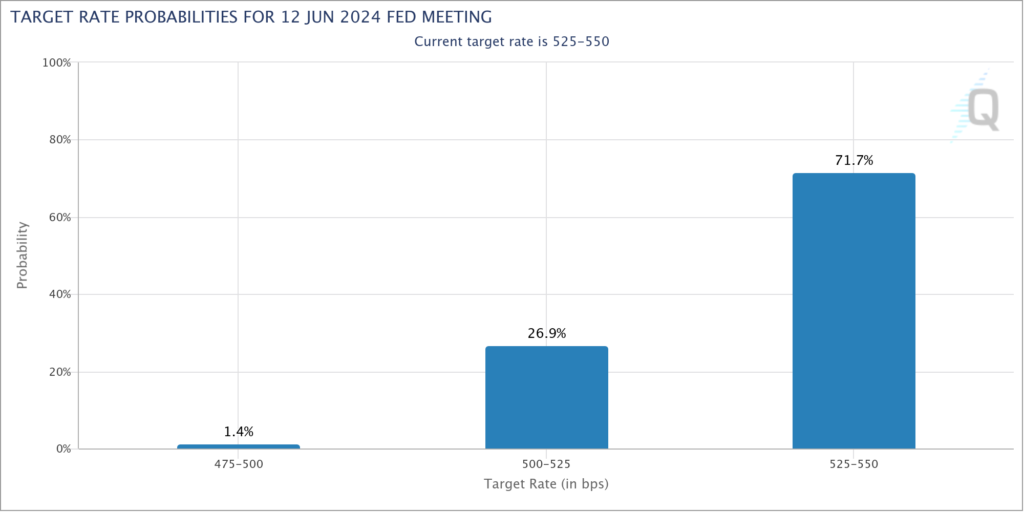

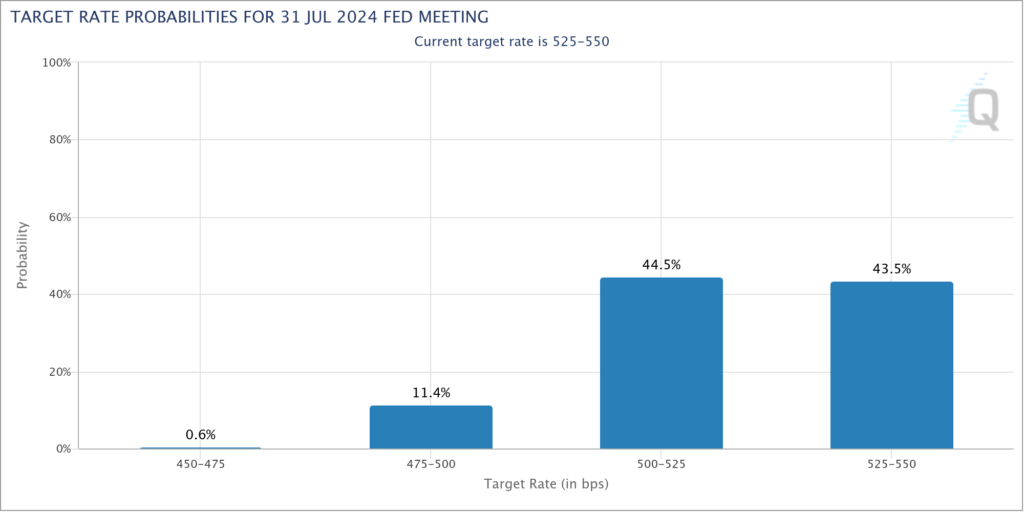

Currently, the Federal Funds Rate stands at 5.25%-5.50%. Till a few days back the probability of Rate Cut was very high for June 2024 meeting. However, with inflation data coming stronger than expected those probabilities are reducing.

Quantitative Tightening

Federal Reserve officials are preparing to notably slow the pace at which they allow Treasury securities to come off the Fed’s balance sheet as they prepare for an eventual end to the drawdown.

According to minutes released on Wednesday of the Fed’s latest policy meeting, held on March 19-20, officials are mindful of the turbulence caused by their last balance sheet drawdown and are preparing to make sure there will not be a replay of the volatility seen in September 2019.

With that in mind, officials last month “broadly assessed it would be appropriate to take a cautious approach to further runoff,” the minutes said, and “the vast majority of participants thus judged it would be prudent to begin slowing the pace of runoff fairly soon.”

The Fed is currently allowing up to $60 billion per month in Treasury bonds and up to $35 billion per month in mortgage bonds to mature and not be replaced as part of a process called quantitative tightening, or QT.

“Participants generally favored reducing the monthly pace of runoff by roughly half from the recent overall pace,” the minutes said, and officials aim to do this by tweaking the runoff of Treasuries and leaving in place the cap on mortgage bond runoff.

Fed Speakers

“Absolutely” no urgency to cut rates.

Mary Daly

Inflation still too high for Fed to cut interest rates.

Jeff Schmid

Fed must weigh impact of restrictive policy stance

Austan Golsbee

Golsbee’s comments came before the release of CPI data.

European Central Bank (ECB)

ECB’s Policy Meeting

ECB had a policy meeting on 11 April 2024.

The Governing Council decided to keep the three key ECB interest rates unchanged.

According to ECB, Inflation has continued to fall, led by lower food and goods price inflation. Most measures of underlying inflation are easing, wage growth is gradually moderating, and firms are absorbing part of the rise in labor costs in their profits. More about this can be read by clicking here and here.

Russia Ukraine War

Ukraine seems to be weakening at the moment. Republican House of Representatives Speaker Mike Johnson is refusing to call a vote on a bill that would provide $60 billion more for Ukraine and the White House is scrambling to find ways to send assistance to Kyiv, which has been battling Russian forces for more than two years.

If one side can shoot and the other side can’t shoot back, the side that can’t shoot back loses. So the stakes are very high

General Christopher Cavoli

Meanwhile the Swiss government will host a two-day high-level conference from June 15th to 16th aimed at achieving peace in Ukraine, it said on Wednesday, although Russia has made clear it will not take part in the initiative.

Equities

The S&P 500 Index lost 1.56% to close at 5,123.41 this week. This index is widely regarded as the best single gauge of large-cap U.S. equities. It includes 500 leading companies and covers approximately 80% of available market capitalization.